The/Nudge Forum

Unifying the livelihoods ecosystem

The/Nudge Forum brings the doers, funders and enablers of the livelihoods ecosystem together to make great things happen

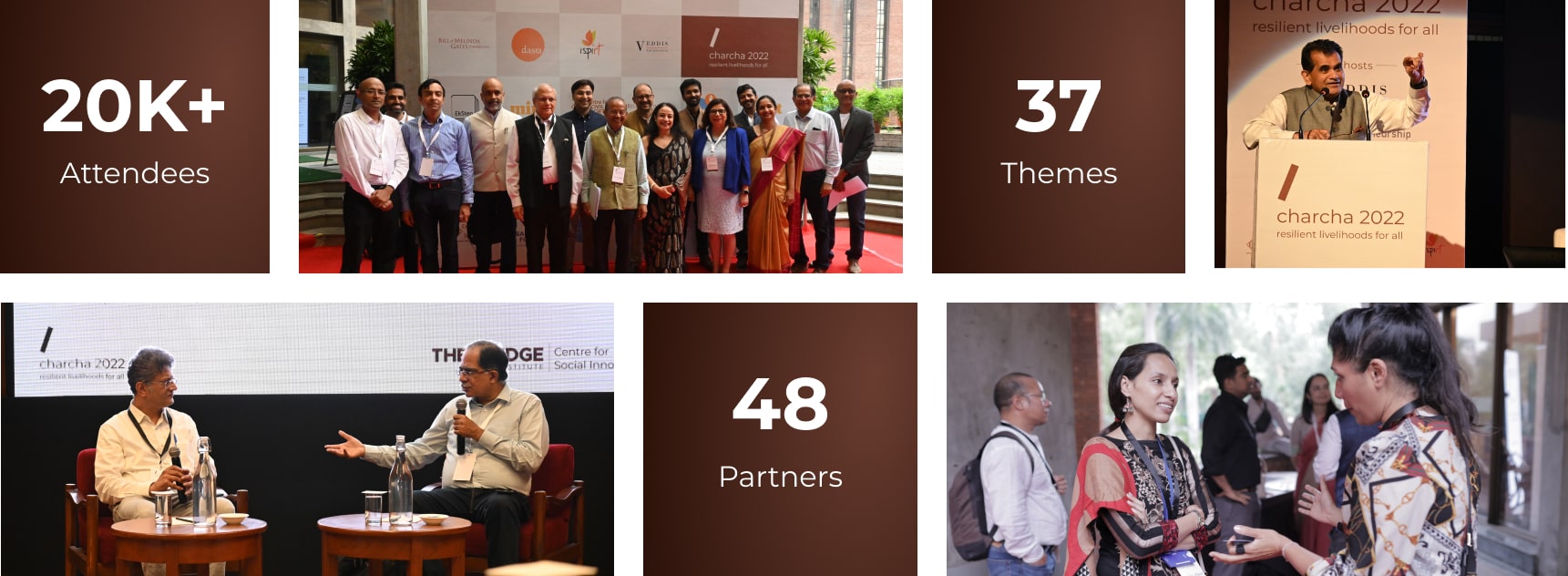

The flagship convening of the livelihoods ecosystem, charcha facilitates dialogues to spark transformative change.

Explore past charchas

Every year, charcha brings the catalysts of the livelihoods ecosystem to discuss, network and learn

Are you ready to charcha?

Be a part of charcha event to discuss upon ecosystem challenges